January 26th, 2026

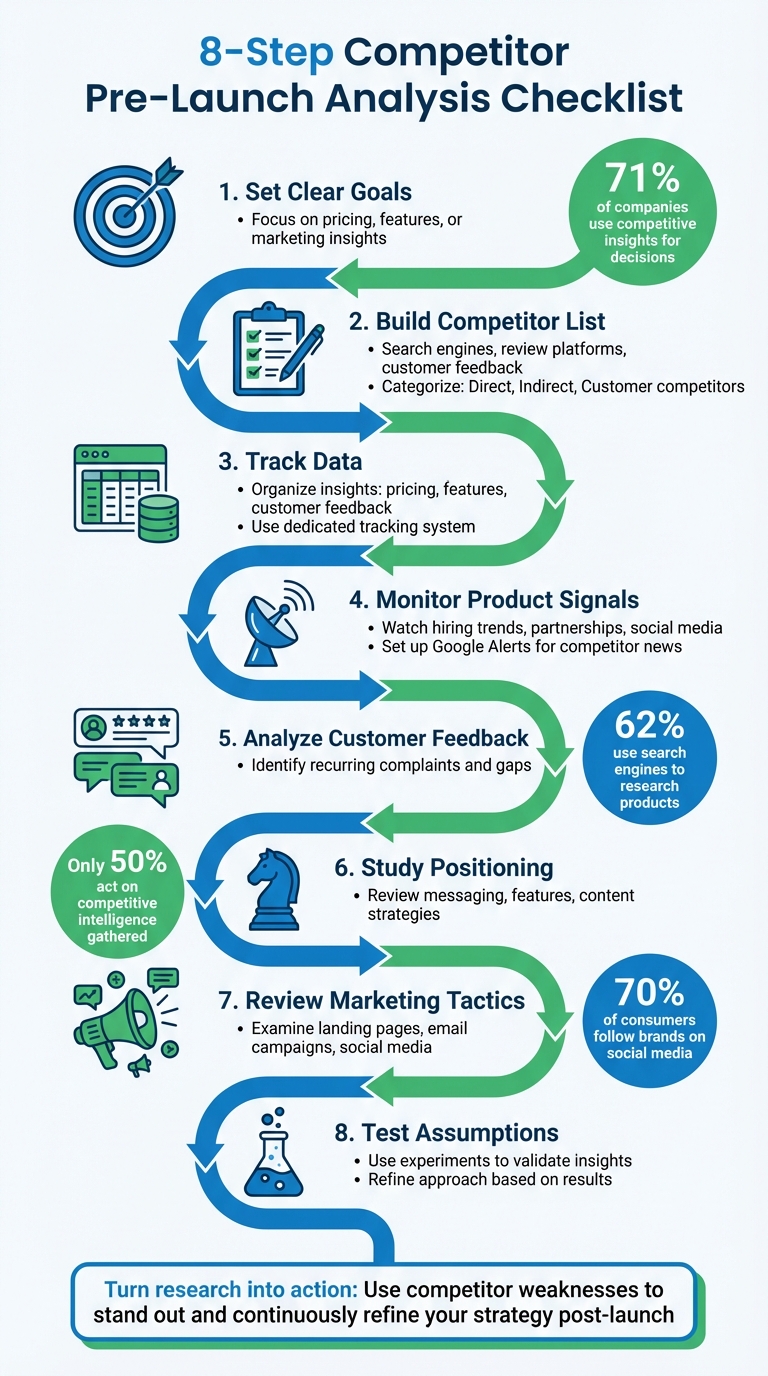

Checklist for Competitor Pre-Launch Analysis

A concise pre-launch checklist to map competitors, track pricing, reviews, product signals and marketing, then turn research into tests and actionable positioning.

Warren Day

Launching a product without studying your competition is risky. A solid competitor analysis helps you spot market gaps, refine your strategy, and position your product effectively. Here's how to do it:

- Set clear goals: Focus on pricing, features, or marketing insights.

- Build a competitor list: Use search engines, review platforms, and customer feedback.

- Track data: Organize insights in a spreadsheet covering pricing, features, and customer feedback.

- Monitor product signals: Watch hiring trends, partnerships, and social media updates.

- Analyze customer feedback: Identify recurring complaints or gaps in reviews.

- Study positioning: Review competitor messaging, features, and content strategies.

- Review marketing tactics: Examine landing pages, email campaigns, and social media activity.

- Test assumptions: Use experiments to validate insights and refine your approach.

The key is to turn research into actionable steps. Use competitor weaknesses to stand out and continuously refine your strategy post-launch. If you need to move faster, you can also validate a product idea in 48 hours using rapid testing methods.

8-Step Competitor Pre-Launch Analysis Checklist

Set Your Analysis Goals and Choose Competitors

Define What You Want to Learn

Start by clarifying your research objectives. Are you trying to refine your pricing strategy, identify key features to prioritize, or figure out which marketing channels deliver the best results? For instance, a striking 71% of companies rely on competitive insights to guide their decisions. But remember, the quality of those insights depends on asking the right questions. Maybe you’re trying to pinpoint the perfect pricing tier, decide on must-have features, or uncover which marketing efforts truly resonate with your audience.

Tie each goal directly to a decision you need to make. If you're determining your entry price, focus on analyzing competitors' pricing structures, discounts, and freemium models. If your priority is shaping your product roadmap, dig into the features customers rave about and the ones they criticize. Interestingly, 52% of businesses say competitor analysis directly influences their market positioning. This approach works best when you zero in on specific areas where you want to stand out.

"Look around at the other experts in your submarket and see what they are selling. Where do you fit into the ecosystem? What can you offer people that's different and special? The goal is to carve out a unique spot in that ecosystem where you can thrive."

- Russell Brunson, Co-founder, ClickFunnels

Turn broad objectives into clear, measurable goals. Instead of a vague aim like "understanding the market", focus on actionable targets. For example, aim to uncover three pricing gaps in your mid-tier segment or identify two underserved customer groups. This level of specificity ensures your research leads to meaningful, actionable insights.

Once you’ve nailed down your goals, it’s time to compile a targeted list of competitors.

Build Your Competitor List

With your objectives in place, narrow your focus to the competitors that matter most. Start by searching industry keywords on Google and reviewing the top 50 results, including ads. Expand your research by visiting review platforms like G2 and Trustpilot, exploring Reddit threads, Facebook groups, and even checking out companies featured at major industry events.

Organize your competitors into categories. Direct competitors sell the same product to the same audience, while indirect competitors address similar problems in different ways - think hotels versus vacation rental platforms. Then there are customer competitors, offering similar products but targeting entirely different market segments.

Take Domino’s as an example: by analyzing competitors and identifying gaps in their menu, they were able to make adjustments that significantly boosted their sales.

"The competitors you pick for the analysis determine the insights you'll get at the end, and the decisions you'll make."

- Tamilore Oladipo, Sr. Content Creator, Buffer

To prioritize your competitor list, create three tiers. Tier 1 should include the most immediate threats or the companies that offer the best benchmarks. One effective method is to assign points based on digital maturity - 1 point for analytics capabilities, 1 for tag management, 2 for tools like heatmaps, and 5 for advanced features like A/B testing. Competitors scoring between 7 and 9 points should be monitored closely as they’re likely your "MVPs".

Don’t forget to ask your customers about alternatives they considered. Their feedback can uncover competitors that might not show up in your initial online research.

Create a Data Tracking System

After identifying your competitors, it’s crucial to organize your insights. A simple spreadsheet can go a long way. Include columns for pricing, features, marketing channels, email frequency, social media activity, and customer feedback. For instance, White Stuff, an ecommerce fashion brand, used this method to analyze competitor checkout processes. They discovered their three-step flow was clunky compared to others. By switching to a one-page checkout, they increased conversions by 37% and average order value by 26%.

To monitor email strategies, set up a dedicated inbox for signing up for competitor newsletters and triggered emails like cart abandonment sequences. This keeps your main inbox clutter-free while giving you a full view of their customer journey. For pricing research, view competitors' pricing pages in incognito mode or on mobile devices - some brands experiment with discounts based on location or referral source.

Keep your tracking system updated regularly. During pre-launch phases, weekly updates work best, while quarterly reviews suffice post-launch. Consistency is key - whether it’s a detailed spreadsheet or a basic tracker, having all your insights in one place ensures you’re ready to make quick, informed decisions when needed.

sbb-itb-9a9c51d

Study Market and Product Indicators

Once you've organized your competitor data, it's time to dig into market indicators that can shape your launch strategy. These insights can uncover opportunities and help you stay ahead of the competition.

Track Product Development Signals

Keep an eye on competitors' hiring pages. For example, if a SaaS company starts looking for AI engineers or enterprise sales experts, it could hint at a new product direction or plans to expand into different markets.

Another key signal? Strategic partnerships and acquisitions. These moves often hint at big product launches or market entries. For instance, a merger or a new partnership might suggest integrated features are on the way. Setting up Google Alerts with competitor names alongside terms like "partnership", "acquisition", or "funding" can help you spot these developments early.

Social media is another goldmine for clues. Executives often share updates or thoughts about emerging trends on platforms like LinkedIn. A CEO's post about a new technology or market shift could hint at innovations months before they're officially announced.

"AI can disrupt you, but you can use AI to disrupt your competitors as well... We can automatically use AI to reconfigure competitors' connections to send data to us."

- Karandeep Anand, President & CPO, Brex

Additionally, win/loss interviews with prospects who chose a competitor can be incredibly revealing. These conversations might uncover product features or positioning strategies that helped seal the deal - details you won't find on a marketing page.

Review Customer Feedback

Customer reviews provide unfiltered insights into real-world experiences. For software, B2B platforms like G2 and TrustRadius are invaluable. For consumer products, check out Amazon or Trustpilot. Look for patterns in complaints, such as missing features or usability issues - these gaps could be your opportunity to stand out.

Compare competitors' marketing claims with the actual feedback in reviews. For instance, if a competitor claims to be "enterprise-ready" but customers frequently complain about slow support responses, you've identified a messaging gap you can exploit. Usability feedback is particularly important - if a product is too complicated, it risks losing customers.

Social listening tools like Brandwatch or Hootsuite can help you track mentions and sentiment in real time. Tools like Buzzsumo can show you which competitor content resonates most with audiences. And with 62% of people using search engines to research products before contacting vendors, online reviews are an essential intelligence source.

Examine How Competitors Position Themselves

Dive into competitors' website copy, social media posts, paid ads, press releases, and newsletters. These materials reveal how they position themselves, their key messages, and their promotional strategies.

"Competitive positioning is about acknowledging this reality and helping your Ideal Customer Profile (ICP) understand where you fit in their mental map."

- Talya Heller, Competitive Positioning Advisor

Use a feature comparison matrix to identify unmet needs. But don't stop at the features competitors claim to offer - dig into their testimonials and customer case studies to understand who actually uses their product and why. This can reveal gaps between their intended audience and their actual customers.

Also, monitor subtle changes in landing pages or blog topics. Even small shifts can signal a strategic pivot or an upcoming product launch. Keep in mind that only 50% of companies actually act on the competitive intelligence they gather - your edge lies in turning these insights into action.

Review Pre-Launch Marketing Tactics

Once you've completed your competitor analysis, it's time to dig into how they attract and convert leads during their pre-launch phase. By understanding their strategies, you can uncover ways to refine your own approach and stand out.

Analyze Landing Pages and Conversion Paths

Start with a quick test: take five seconds to look at a competitor's landing page and note three key takeaways. If you struggle to describe their message in that short time, it's a sign their communication might be unclear. This gives you an opportunity to create more straightforward and effective messaging.

Pay attention to whether they focus on shared features (Points of Parity) or highlight their unique strengths (Points of Difference). Also, evaluate their calls-to-action (CTAs). Are they generic, like "Get Started", or specific and engaging, such as "Design My Office"? As Chris Goward, Founder of WiderFunnel, aptly says:

"Your PODs [Points of Difference] are where you'll win the game".

Look at how they collect leads. Are they using simple, one-field email forms, or are they asking for extensive details upfront, potentially discouraging sign-ups? Tools like Ghostery and BuiltWith can help you audit their tech stack.

Ultimately, a clear, well-designed landing page is critical for pre-launch success. If you're ready to act on these insights, tools like LaunchSignal can help you create and test high-performing landing pages to validate your ideas effectively.

Monitor Email and Social Media Activity

Sign up for competitor newsletters to get a firsthand look at their email strategies. Tools like Unkover can help you track and archive their email sequences for further analysis. Andy McCotter-Bicknell, Head of Competitive Intelligence at Apollo.io, shares a useful tip:

"There have been multiple research projects where I've messaged competitors' customers on LinkedIn or via email asking for info. And I'm surprised how willing folks are each time to share their thoughts".

On social media, monitor follower growth, posting frequency, and engagement metrics like likes, comments, and shares. Since around 70% of consumers follow brands on social media to stay updated on new products, competitors are likely leveraging these platforms heavily during pre-launch. Use tools like the Facebook Ad Library to analyze their sponsored content and targeting strategies - this reveals which messages they're testing.

Also, observe peak engagement times. For instance, if a competitor's posts consistently perform best on Tuesday afternoons, it might indicate when your shared audience is most active. Look out for influencer collaborations and sponsored posts to see how they're building their community.

These observations naturally set the stage for a closer look at competitors' content and search strategies.

Study Content and SEO Approaches

Dig into competitors' organic search traffic and identify the keywords they rank for in the top 10. Long-form content (7,000+ words) and posts with structured visuals like images and lists tend to drive higher engagement and traffic.

Analyze their backlink profile to spot "link magnet" content - topics that draw attention and authority in the industry. Conduct a keyword gap analysis to find terms where competitors rank but you don't, uncovering potential opportunities in your niche. Additionally, keep an eye on their Domain Authority and Brand Authority scores (rated on a 1-100 scale) to evaluate their online presence. As Moz wisely points out:

"The question isn't 'What are they doing?' but 'How can we solve this problem better for our audience?'"

Turn Findings into Action Plans

Take the competitor research you’ve gathered and turn it into concrete steps to sharpen your pre-launch strategy. The goal? Organize, experiment, and apply what you’ve learned to gain an edge in the market. Here’s how to break it down and make it work for you.

Build a Comparison Scorecard

Start by creating a structured way to compare competitor strategies and pinpoint areas where you can improve. A scoring system can help you measure their digital maturity - assign points for tools like basic analytics (1 point), tag management (1 point), heatmaps (2 points), and A/B testing (5 points). Competitors scoring between 7 and 9 points are likely the ones leading the pack.

Set up your scorecard to focus on specific categories: business basics (like revenue, funding, team size), product features, marketing channels, customer sentiment, and technology stack. This approach makes it easier to identify patterns and actionable gaps.

For example, track the "good-to-bad" ratio in competitor reviews to uncover frustrations you can address. White Stuff, an ecommerce fashion brand, spotted that competitors offered streamlined one-page checkouts, while their own process had three steps. Acting on this insight, they adopted a one-page checkout and saw a 37% jump in conversions and a 26% rise in average order value.

Test Your Assumptions

Think of competitor tactics as starting points, not final answers. As Peep Laja, Founder of CXL, advises:

"The thing you copy is a hypothesis - and you need to test it. Run it against your current site and see if it makes a difference."

Tools like LaunchSignal can help you validate assumptions about pricing, messaging, or features before committing major resources. For example, you could create several landing page variations: one emphasizing features competitors highlight, another focusing on gaps they’ve missed. Use tools like email capture forms, short surveys, or even fake checkouts to gather real user feedback and see what resonates most with your audience.

Make sure to define what success looks like before testing. Maybe you’re aiming for a 15% email capture rate or 100 survey responses in the first week. Setting clear goals helps you avoid confirmation bias when analyzing results. Quick tests, like reviewing search queries or asking potential customers about their frustrations with existing solutions, can be done in under an hour and reveal valuable insights. These experiments will guide you in crafting a market position that stands out.

Identify Where You Can Stand Out

Focus on Points of Difference (PODs) - areas where you can solve customer needs that competitors are neglecting. As Chris Goward, Founder of WiderFunnel, puts it:

"Your PODs [Points of Difference] are where you'll win the game."

Look for actionable clues in 2–4 star reviews. These often include suggestions for features customers like but find incomplete. For instance, if high shipping costs are a recurring complaint (and a leading cause of cart abandonment), you could stand out by offering transparent pricing or more flexible return policies.

You can also monitor competitor job postings on platforms like LinkedIn. A surge in product manager roles might hint at new product development, giving you a chance to adjust or speed up your plans.

Keep in mind that 71% of companies rely on competitive insights to guide business decisions, and 47% say studying competitors reveals new ways to boost revenue. The key is to focus on problems competitors have researched but dismissed - or features they’re struggling to implement effectively. By addressing these gaps, you position yourself as the better choice in the eyes of your audience.

Conclusion

Competitor pre-launch analysis is your roadmap to understanding the strengths, weaknesses, and overlooked opportunities of your rivals. By using a checklist approach, you can systematically tackle everything - from setting clear objectives and tracking product signals to diving into marketing strategies and customer sentiment. The key is to organize your findings and act on them with purpose.

Once you've gathered your insights, it's time to put them to the test. Instead of assuming your competitors' strategies will work for you, turn your research into experiments. Use tools like LaunchSignal to quickly validate your assumptions. Experiment with landing pages to test different messaging, pricing strategies, or feature combinations. Collect real feedback - whether it’s through email sign-ups, survey responses, or even simulated checkout attempts - to uncover what truly resonates with your audience before committing to a full launch.

To carve out your niche, focus on identifying your Points of Difference. Dig into 2–4 star reviews for clues about unmet customer needs, and keep an eye on competitor job postings for hints about their strategic direction. Create a comparison scorecard to highlight areas where you can stand out. The goal isn't to outperform competitors at everything - it’s about being distinct in ways that matter most to your target audience.

Finally, remember that competitor analysis isn’t a one-and-done task. Markets evolve, new players enter, and customer expectations shift. Stay vigilant, keep experimenting, and refine your strategy as you go. By treating competitive analysis as an ongoing effort, you’ll maintain the agility needed to launch and thrive in a dynamic marketplace.

FAQs

How can I identify which competitors to analyze before launching?

To analyze your competitors effectively, start by dividing them into two groups: direct competitors (those offering similar products or services to your target audience) and indirect competitors (those meeting the same needs but with different approaches or targeting slightly different segments). Focus on competitors that meet at least one of these criteria:

- Comparable size: Companies with similar revenue or user numbers can provide insights that are directly relevant to your business.

- Rapid growth: Competitors experiencing fast growth often signal trends or strategies worth paying attention to.

- Audience overlap: Use tools like search trend data to identify competitors whose audience aligns closely with yours.

- Similar products: Look for companies offering comparable features, pricing, or distribution methods.

After creating a shortlist, prioritize competitors with accessible public data. This could include details about their website structure, advertising strategies, or SEO performance. Having this information makes your analysis more detailed and actionable. Tools like LaunchSignal can also help you refine your positioning by gathering real user feedback and efficiently comparing your ideas.

How can I effectively track my competitors' marketing strategies?

To keep tabs on competitors' marketing strategies, start by keeping an eye on their main communication platforms. Tools can help you dive into their SEO performance, tracking things like keyword rankings and backlink growth. Also, take a close look at their paid ads, social media posts, and content themes to spot patterns in their messaging and audience engagement. Signing up for their email newsletters can give you a sneak peek into their campaign schedules, offers, and broader strategies.

Another approach? Reverse-engineer their winning campaigns. Break down their funnels, creative assets, and offers - not to copy, but to understand what works. Automated tools can also alert you to updates like pricing changes, new product features, or funding news, so you can react quickly. For even deeper insights, landing page analytics tools like LaunchSignal let you test your ideas by gathering real user data, such as email signups and conversions, and compare those results to competitor benchmarks. By blending these strategies, you’ll have a well-rounded view of your competition and actionable insights to sharpen your own approach.

How can I find and use competitor weaknesses to improve my strategy?

To spot where your competitors fall short, dive into their pricing structures, product features, customer reviews, and social media feedback. Pay close attention to recurring complaints - things like steep prices, limited functionality, or subpar customer service. Once you’ve gathered this information, plug it into a SWOT analysis to clearly outline where they’re vulnerable.

From there, use these weaknesses as a springboard to shape your strategy. For instance, if customers frequently mention that a competitor’s support is too slow, prioritize building a faster and more dependable support system - and make sure to spotlight this in your marketing. If their product is missing key features, focus on developing those and test them with actual users to gauge their impact. By validating these insights and refining your approach based on user feedback, you can transform competitor flaws into opportunities that set your business apart.

Start validating ideas in minutes not days

Create high-converting landing pages. Test with real users. Get purchase signals. Know what to build next.

Visit LaunchSignal